“Crypto Market Heavies: Uncredited Heroes of Limited Liquidity Trafficking”

The cryptom market is known for its high volatility and rapid price fluctuations, making it an exciting space for traders. However, there are also various tools and strategies that allow traders to use limited market liquidity, which are often referred to as the “market”.

One of these tools is Binance, a popular online trading platform that has become a center for crypto -trading. In this article we dive into the world of the market, which we focus on limited orders and their importance.

What are market traders?

A market creator, also known as a broker of the limit or market, is an entity that provides market liquidity on the market by purchasing and selling assets for prevailing market prices. In other words, they act as an intermediary between buyers and sellers and absorb any prices of prices in this process.

Why are market participants important?

Market creators play a decisive role in maintaining order books and ensure that there is always someone who is willing to buy or sell an asset at a given price. This stability helps prevent market accidents and provides a security network for merchants who may need to lock up profits quickly.

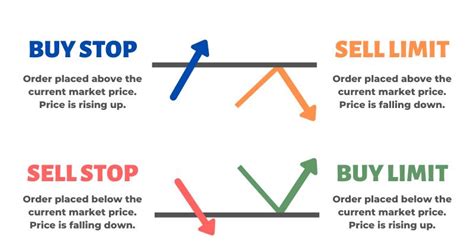

In the case of Binance, its market manufacturer’s program allows users to use limited liquidity by placing limit orders. When you place a limit order with Binance, you basically set the price at which you are willing to sell an asset if it reaches this price. If the market price does not meet the required level before the deadline, the order will automatically fill in, allowing you to lock your profits.

How do the market participants work on Binance?

As regards binance, market manufacturer orders are usually carried out on the basis of the following rules:

- Price : Limitation limit must be made for or below a specific price.

- Date : The term for execution is set by the merchant (in this case).

3.

For example, if you place a limited order for Binance for sale $ 100,000 and the market price will increase above $ 50,000, the order will not be filled in until the price drops below $ 40,000. If this happens, the order will be made, allowing you to lock your profits.

Conclusion

Market participants, such as Binance, play an important role in maintaining liquidity and stability in the crypto -market market. By placing limit orders with market creators, traders can use limited liquidity and ensure their profits, even in times of high volatility. When the market is constantly evolving, it is essential that traders remain informed about these tools and strategies, allowing them to orientate in the difficult world of crypto -trading.

Note:

This article is intended as a general overview of the limit orders and market creators on Binance and should not be considered investment advice. Always do your own research and consult a financial advisor before doing any stores.