“Replen by default: the unpredictability of cryptocurrency and the impact on ethereum (ETH)”

The world of cryptocurrency is known for its volatility and unpredictability. One aspect that has been particularly concerning in recent times is the phenomenon of “EGTT,” a term coined by reddit user and/rectsauce, which referers to individuals who have laest significant amounts of cryptocurrency due to unfreseen circumstances.

In this article, we’ll explore what a means in the context of cryptocurrency and ethereum (ETH), as well as the implications it has on the entire market.

What is a rack?

The term “rack” was first used by and/kingsauce in a 2020 reddit thread discussing the aftermath of a major hack that would take place on the decentralized Finance (Defi) Protocol, compound. The user had invested heavily in compound and lost nearly all their funds due to the security breach.

However, instead of simply losing his money, EGT’s experience was more complex. He was unable to access his funds for several days, which led to a situation where he was forced to sell his assets at rock-bottom prices. This ultimatby resulted in him Owing compound Developers back thousands of dollars.

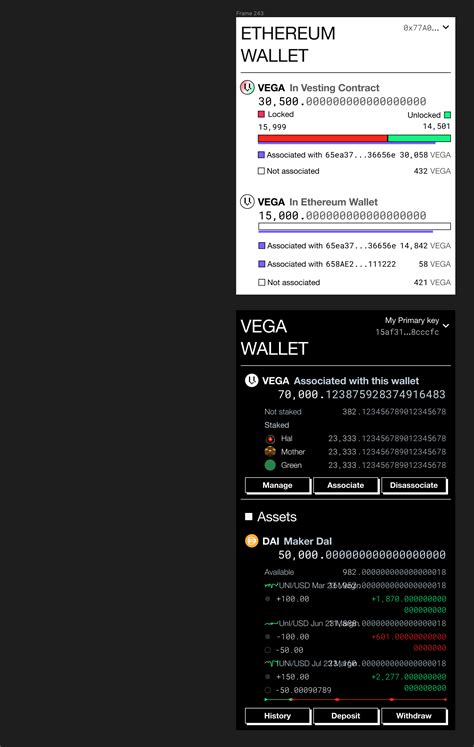

The Vesting Period

As part of the Ethereum 2.0 upgrade process, the network is moving away from its proof-of-work (POW) Consensus algorithm and towards a more energy-efficient, proof-of-stake (POS) System. To facility this transition, a new feature has been introduced called “vesting,” which allows users to lock up their eth for a certain period before unlocking it.

The idea behind vesting is to incentivize users to hold their assets until the pos consensus algorithm is fully implemented on the network. This will not only reduce Ethereum’s environmental impact but also provide a safety net for investors who may be lose money in the short term.

However, one of the main concerns surrounding vesting is that it can lead to “rect” situations where users are locked out of their funds and forced to sell at a low price due to market fluctuations or other unfruitseen circumstances. This has led some users to question whether the Ethereum Community will prioritize the long-term sustainability of the network over short-term gains.

The Case for Vesting

While it’s true that vesting can create an environment repeat for re -situations, many experts argue that this is a necessary step towards creating a more sustainable and resilient cryptocurrency ecosystem. By incentivizing users to hold their assets, vesting can help prevent reckless speculation and ensure that the network remains liquids in times of crisis.

Moreover, the Ethereum Team has explicitly stated their intention to prioritize user safety over-term gains. In an interview with Coindesk, Vitalik Buterin, the Creator of Ethereum, explained that the team will “do whatever it takes” to protect users’ funds and ensure the long-term viability of the network.

Conclusion

The re -phenomenon is a stark reminder of the unpredictable nature of cryptocurrency markets. While vesting can create an environment where re -sittuations may arise, it’s also a necessary step towards creating a more sustainable and resilient ecosystem.

As we continuue to navigate the complexities of cryptocurrency, it’s essential that market participants prioritize user safety over-term gains. By working together to implement measures like vesting, the Ethereum Community can build a more secure and vibrant cryptocurrency future for all.

Disclaimer: This article is not investment advice, and all information provided should be used as a general guide only. Cryptocurrencies are subject to market fluctuations, and investors should do their own research before making any decisions.