cryptocurrency: Basic analysis of the Altcoin-A step by step investment Guide

In recent years, the world of cryptocurrencies has been meteoric growth, many new Altcoins are entering the market, and existing has gained popularity. While some investors have achieved wealth by buying noise, others have undergone significant losses due to irregular markets and lack of fundamental analysis. In this article, we provide a step -how to make a fundamental analysis for the Altcoin investment.

Understanding the basic analysis

Basic analysis is a process of internal asset value analysis, taking into account various factors, such as market capitalization, rotation volume, price factor (P/E) and other values. Understanding these factors investors can make known decisions regarding purchase or sell a certain cryptocurrency.

Step 1: Examine the currency

Before conducting a fundamental analysis, it is necessary to examine a given currency. This includes:

* market capitalization : total value of all overdue markets on the market.

* Trading volume : Number of coins traded per day.

* Price religion indicator (P/E)

: Price of a coin divided into its earnings (if it is publicly available).

* Team programmers : Reputation and experience of project programmers.

Step 2: evaluates the values of the coin

After examining the currency, the time has come to assess different values that can provide information about its internal value:

* Block prize : Number of coins awarded to each miner.

* Transaction fee : sum of coins paid by users for each transaction.

* Offer and request

: Current currency offer and investors’ request.

* Employment of regulations : Searching for regulations in your country or region.

Step 3: Analyze coin techniques

Technical analysis includes the study of charts and models to predict future price movements. This may include:

* TREATMENTS indicators: indicators that measure the last currency price movement, such as a relative resistance rate (RSI) or a lateral oscillator.

* Horizers of support and resistance : Key points where prices usually reverse or move away.

* model recognition : Identification of common models in the chart.

Step 4: Compare with market leaders

Comparison of the basics of coin with the foundations of market leaders can provide valuable information:

* market capitalization : total value of all overdue markets on the market.

* Trading volume : Number of coins traded per day.

* Price religion indicator (P/E) : Price of a coin divided into its earnings (if it is publicly available).

* Team programmers : Reputation and experience of project programmers.

Step 5: Consider the feeling of the market

Market feeling is a key factor in determining the cryptocurrency value:

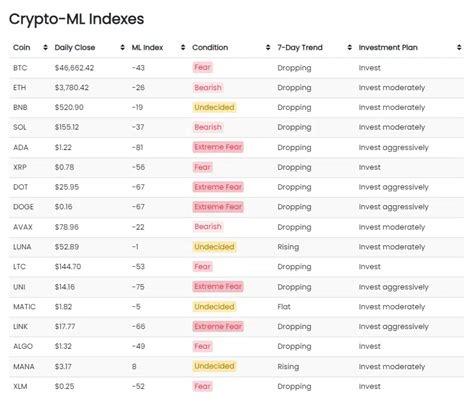

* Indexes for fear and greed : Investor’s feelings.

* Sentture indicators : indicators measuring market feelings, such as Bolninger ranges or balance sheet volume (OBV).

Application

The basic analysis of cryptocurrencies requires full understanding of various factors that can affect the value of assets. After these steps and conducting thorough research, you can provide knowledge about investments in Altcoins. Remember to always remember about messages and trends on the market because they can have a significant impact on the price of cryptocurrency.

additional tips

* Dize your portfolio : spread to various cryptocurrencies to minimize the risk.

* Set clear goals : Specify what you want to get by investments in Altcoins, such as long -term growth or short -term earnings.