“sentimentally aware: understanding of the cryptocurrency market to kill and its role in market dynamics”

The cryptocurrency market is a complex and constant evolution ecosystem that has caught significant attention in recent years. In essence, he revolves around the idea of decentralized digital currencies such as Bitcoin, Ethereum and others. However, under this surface, there are a multitude of players who shape market behavior. Among these players, there is a concept known as the market taker.

What is a market taker?

In essence, a market taker is a company or institution that buys and sells financial instruments, including cryptocurrencies, with a high degree of condemnation in its value. The term “market taker” was first introduced by economists Nouriel Roubini and others in 2018 to describe the dominant role these companies play in the formation of market sentiment.

Role of market borrowers

Market buyers have several important characteristics that allow them to influence market dynamics:

- Concentration : They are concentrated, which means they control a large part of the capitalization of the market.

- Conviction

: They are motivated by conviction in their market positioning, which can be influenced by various factors, such as fundamental analysis or technical analysis.

3.

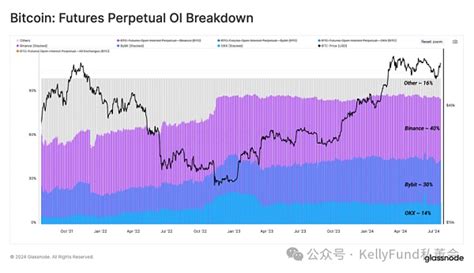

Perpetual future

Another crucial concept is the Perpetual Future Market, a type of contract that allows traders to buy or sell assets at any time in the future, without the need for physical delivery or liquidation. Perpetual futures are characterized by their high volatility and lack of liquidation risks.

Market buyers usually explore these characteristics to profit from price movements. By controlling the flow of order books, they can influence prices and generate returns by various means, including negotiating strategies, such as spreading bets and hedge of options.

Market feeling

Market feeling is a critical aspect of market dynamics, as it reflects the prevailing attitude and emotions among traders and investors. Market buyers usually display a strong market feeling due to their condemnation of market positioning.

For example, if a market taker buys a specific asset at a high price, it may demonstrate confidence in its long -term perspectives, leading to increased commercial activity and higher prices. On the other hand, if they sell at a low price, they may show a lack of conviction, resulting in decreased commercial activity and lower prices.

Impact on market behavior

Market buyers have significant implications for market behavior:

1.

2.

- Economic Feeling : The confidence or conviction of market buyers can influence economic feeling, with negative feelings leading to greater risk aversion and decreased investment activity.

Conclusion

The concept of market taker is crucial to understanding the dynamics of the cryptocurrency market. By recognizing their role in the formation of feeling and market behavior, investors can sail better in these markets and make informed decisions. The future perpetual futures market is an excellent example of how market participants exploit these characteristics to profit from price movements. As the cryptocurrency scenario continues to evolve, it is essential to be tuned to the complex interaction between market buyers and their impact on market dynamics.

References

- Roubini, N., & Shleifer, A. (2018). The artificial expectation market? The Journal of Economic Perspectives, 32 (2), 23-40.

- FAMA, E. F.