Ethical consequences of algorithmic trading in Krypto

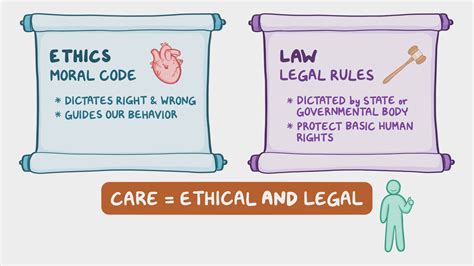

The rapid growth of markets with cryptomes has led to a new type of trading system that caused many experts and investors to question the ethics of its use. Algorithmic trading, also known as machine learning trading, uses complex algorithms to perform stores with almost fundamental speed and accuracy. However, this efficiency is worth the price.

The rise of algorithmic trading in Krypto

In the first days of the crypto market, traders relied on people’s intuition and experience with investment decisions. However, when the spread of algorithmic trading platforms, many investors currently have access to sophisticated algorithms that can analyze a huge amount of market data in real time. Although this has increased efficiency and accuracy, this also raises significant ethical concerns.

Key concerns

1

Lack of transparency : Algorithmic trading systems often operate behind the scenes, which makes it difficult to understand traders and investors how their stores are carried out. This lack of transparency can lead to distrust and undermines confidence in markets.

- Morning and discrimination : Machine learning algorithms are not perfect and can be distorted to certain types of data or patterns. For example, an algorithm that favors long -term investments may prefer assets that have historically achieved good results over those that have experienced significant pricing fluctuations.

- SELF-ZAUJMY vs. Market interest : Algorithmic trading systems often prefer profits over long -term health market health, leading to a potential conflict between interest in interest in interest and market interests.

- Regulatory uncertainty : The decentralized nature of the crypto -market market has created an uncertain regulatory environment, and many investors were vulnerable to abuse of reckless merchants.

- Cyber security risks

: Algorithmic trading systems may be vulnerable to computer attacks, which could jeopardize the security of user accounts and sensitive financial information.

Case Studies

Several significant cases have emphasized the ethical consequences of algorithmic trading in Krypto:

1.

- Bitwise Inc. Data violation : Bitwise Inc., another prominent cryptocurrency exchange, was hacked in 2020, leading to theft of sensitive customer data.

3.

Recommendations

To address the ethical consequences of the algorithmic trading in crypt, the regulatory authorities and the leaders of the sector must take the following steps:

1.

- Implement the robust audit procedures : Perform regular audits in algorithmic trading systems to find out any potential bias or security vulnerable sites.

- Support transparency and responsibility : Encorce algorithmic trading platforms to be transparent in connection with the use of machine learning algorithms and have provided clear explanations for their business decisions.

- Support ethics culture : Develop standards and proven procedures in the whole industry that prefer market integrity, transparency and responsibility.

Conclusion

The rise of algorithic trading in the crypt has led to a new type of trading system that raises significant ethical concerns.